5% on the first$48,535 of taxable income, plus.Your Federal Tax Bracket Depends On Your Taxable Income

TurboTax standard products or higher can help you optimize the use of your deductions. It helps to know which deductions you can carry forward, like moving expenses, to future years rather than claiming the total amount in one year and losing the remaining balance. Your taxable income would be $0, as opposed to -$3,000. For instance, say you earned $20,000, and your child care expenses, moving expenses, and employment expenses totaled $23,000. If your deductions are higher than your earned income, your taxable income would be considered $0. You can subtract deductions from your total income to get your taxable income. Any deductions related to self-employment work.The Registered Retirement Savings Plan (RRSP) deduction.Credits are applied after you calculate your taxes to further reduce your owing amount or result in a refund. What is the difference between deductions and credits?ĭeductions are applied to your total income to reduce your taxable income before you apply your federal and provincial taxes. are amounts you would add to your total income. For instance investment activities like dividends, stock options, interest, renting a property, capital gains, selling capital properties, etc. It also includes the income you earned from other sources. It includes any money you earn from employment – including self-employment, commissions, bonuses, gig-work, or casual employment and tips.

Your total income is just what it sounds like - all of the money you brought in for the year. But what information is most important in providing that snapshot? Total Income

#TURBOTAX RETURN CALCULATOR HOW TO#

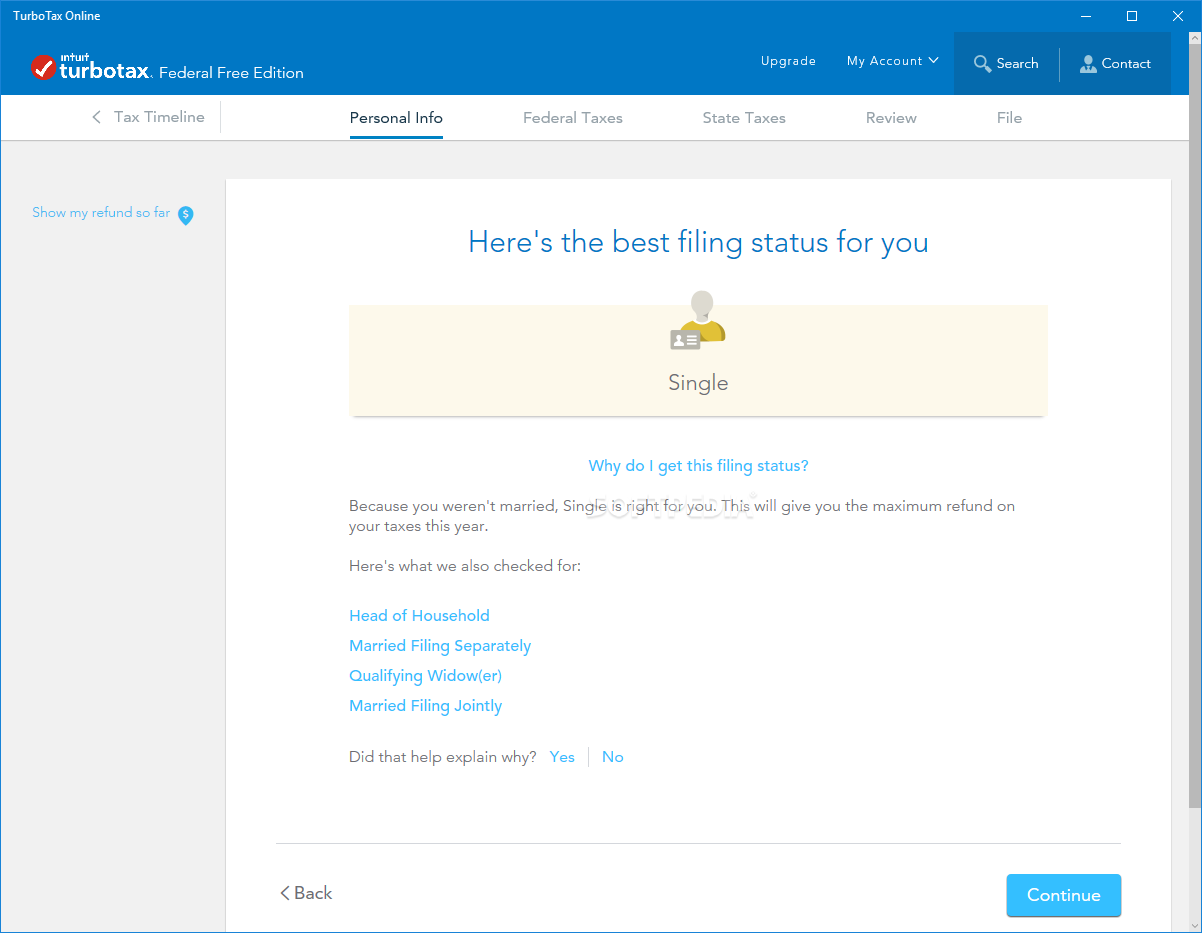

Sure, you could use free online tax preparation software like TurboTax and fill in a couple of key facts and you should see fairly quickly and easily if you are getting money back or will owe money. Or you can ask for Real Tax Expert Advice on how to report your income or apply deductions. If you are expecting a tax refund, you can get a fairly accurate idea of how much you will be receiving before you actually file your tax return.

0 kommentar(er)

0 kommentar(er)